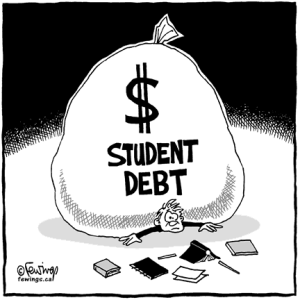

Lawyers.com recently posted an article entitled No Escape from Student Loans through Bankruptcy, describing the challenges many face when considering filing for bankruptcy as a financial fresh start. With college debt on the rise and jobs scarce, many consider bankruptcy but rarely find it effective for student loan debt.

Unfortunately, unlike other debts, you can’t just make student loan debt disappear through bankruptcy filing. However, Rothamel Bratton Bankruptcy Attorney Ari Linden states, while discharging student loans is typically not possible, there are circumstances that exist where a debtor can prove “undue hardship” such that they cannot maintain a basic standard of living while repaying the loan. This is a difficult threshold to overcome and requires bringing litigation against the creditor of the student loan. As such, it can also be an expensive undertaking and the likelihood of success can be relatively low.

However, Linden continues, the existence of student loans and the high likelihood that these obligations cannot be discharged should not be considered a bar to filing a bankruptcy. In fact, at Rothamel Bratton we are successful in reorganizing the obligation and reducing the corresponding monthly payment through the use of a Chapter 13 Bankruptcy filing. Since the payment required under a Chapter 13 “Plan” is based on ability to pay after deduction of all necessary expenses compared to income, this calculation can significantly reduce the amount to be paid on a monthly basis to the student loan creditor. They will receive a smaller payment each month, through the Plan, and since the Plan can be either a three (3) or five (5) year obligation, the loan is considered current even with the reduced payments.

Questions regarding Bankruptcy, please call our Haddonfield, NJ office at 856-857-6000.

You can read the complete Lawyers.com article here.